Gross Lease; Net Lease; Double Net; Triple Net. What do these terms mean? What is the appropriate Commercial Lease for your circumstances? It is not simply a case of what’s the best form of lease for the landlord or for the tenant. Each arrangement, or a blended arrangement, has advantages and disadvantages for either party depending on the premises, term and business involved. The best arrangement for our clients, landlord or tenant, is not always an obvious choice. A Gross

Category: Corporate

Business Asset Sales and Employees

One of the most complex and difficult areas to deal with on a business asset sale is the transition and/or termination of the seller’s existing employees. When business assets are sold, instead of corporate shares, the employees do not automatically pass to the buyer. At the Letter-of-Intent stage, the parties often overlook adequate negotiation in respect of employee transition issues. These issues are often only lightly addressed on the LOI. This may be because it is a complex area involving

New Employment Contract Blog! An Introduction to Employment Contracts

This is an introduction to our new semi-regular blog posts about Employment Contracts and the importance of continuously updating them. We frequently act for a wide variety of companies across diverse industries in preparing, normalizing, and updating their employment agreements, and non-employment contractor agreements. Often employers may not realize that their standard documents may not be in accordance with various aspects of the Employment Standards Act. These integral documents for an Employer and Employee are used to clearly define the

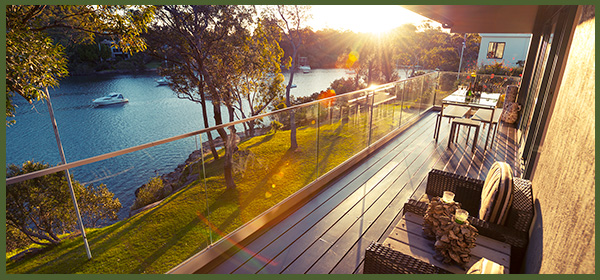

Ontario Allows Personal Real Estate Corporations (PREC’s)

Real Estate Agents and Brokers are now able to incorporate their own business through a Personal Real Estate Corporation. This can provide a variety of benefits to agents and brokers alike.

Recent Comments